Last updated on June 21st, 2021 at 01:16 pm

The IRC Section 1031 of the tax code is the single biggest advantage real estate investors have over all other investors. The ability to roll over taxes to the next sale is a great way to build wealth, not lining Uncle Sam’s pockets.

Unfortunately, the time frame for a 1031 exchange can seem confusing at first. Figuring out what needs to happen within 45 days, 180 days, and other periods can be unclear. This guide simplifies the time frame for 1031 exchange to its most basic level.

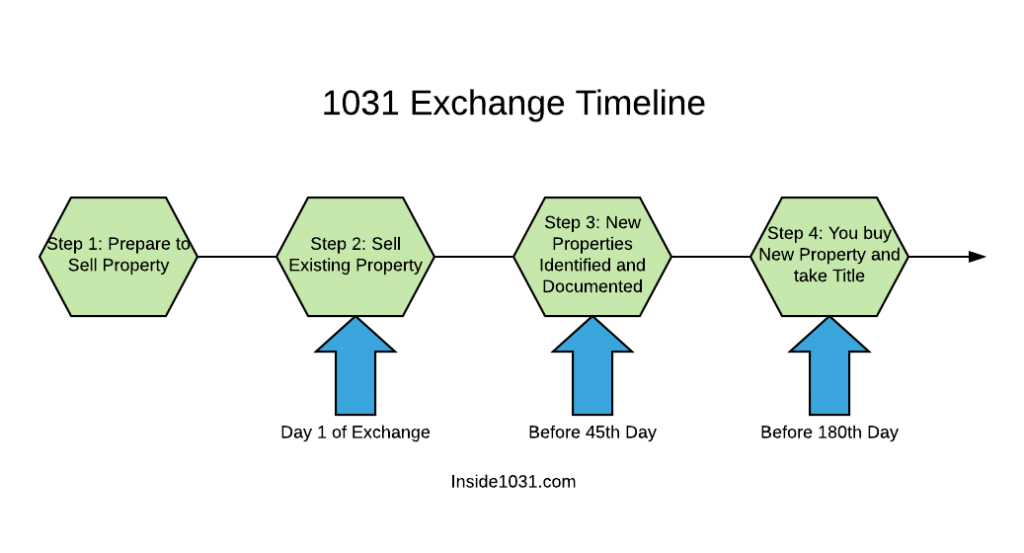

The time frame or timeline requirements for a 1031 exchange can be broken into three sections.

The first is when the “clock” starts, which is when your old property is transferred the buyer. The second is the 45-day identification period for finding a new, replacement property. This is the most confusing and where we’ll spend the majority of this article. The third is the 180-day exchange period, the deadline to complete the purchase. We’ll walk through these timelines in detail and give examples for all three major types of exchanges (delayed, reverse, construction).

As always, we recommend working with a 1031 exchange company before starting your exchange. They’ll make sure that your exchange is legal and less likely to fail. If you’re still confused on the time frame for 1031 exchange, please contact us and we will connect you with a qualified intermediary.

Table of Contents

Time Frame for 1031 Exchange – The Start

The first thing that causes confusion with time frames for 1031 exchange is also the first thing that happens during an exchange. It’s when you sell your old property and the 45 and 180-day clocks starts. Some “experts” mistakenly say the clock starts when your old property goes under contract. Others will say it’s when you start looking for new, replacement properties. Both of these are wrong! In a delayed exchange, the clock starts when the buyer of your old relinquished property takes ownership.

If you are selling multiple properties as part of your exchange, the clock starts when you sell the first property. This is for a delayed exchange, the most common type. We’ll cover timelines for other types, including reverse and construction exchanges later in this article.

You may be asking “what is the actual date the buyer takes ownership of my old property?” With complex transactions this can be difficult to determine.

The most simple guideline is that it’s the date ownership was “transferred.” A transfer is defined by the IRS in this way: Whatever the date you sign the documents proving the transfer (most often a deed), or the date when that document is put into public records, whichever comes first. The commonly used date is what’s on the title company’s HUD-1 Settlement Statement, which is typically when the transaction closed.

The 45-Day Identification Period

After you sell your property and the exchange begins, the first timeline to meet is the 45-day identification period. This means you need to identify and document potential replacement properties within 45 days. This frame for 1031 exchange is not negotiable under any circumstances. There can be some confusion during this step. Some “experts” claim that you can buy a different replacement property than one that’s identified during the 45-day period. This is not true! You must close on one of the identified properties in order for your exchange to be legal.

The next point to consider are the rules for how many properties you can identify, and their overall value. To simplify it, there’s two rules to consider:

Three-Property Rule

This says if you identify three or fewer properties, they can be any Fair Market Value (FMV) you want. Let’s say you sold a duplex for $400,000. You can identify one property worth $400,000, one worth $580,000, and a third worth $2.5M if you want. You don’t want to buy a replacement property worth less than your old property (or you’ll have boot). That said, if you want to buy a new property worth substantially more the IRS won’t stop you.

The 200% Rule

If you want to identify more than three replacement properties, their combined Fair Market Value (FMV) cannot exceed 200% of the FMV of your old home. Basically, the IRS is trying to ensure you don’t “identify” the entire neighborhood and get sidetracked during your 45-day identification period.

We’ll explain this rule with an example. If you sell that same duplex for $400,000, you can identify as many properties as you’d like. The only limit is that the combined FMV of the new properties cannot exceed $800,000 (200% of your sale price). If you wanted, you could identify 10 properties that are $80K each. Most investors who want to sell a valuable property in a coastal area and diversify into multiple properties use this rule when they’re coming up against the time frame for 1031 exchange.

Time Frame for 1031 Exchange – Documenting Your Identified Properties

In order to reduce risk that your exchange fails, you must document the properties you’ve identified. This is where the services of a qualified intermediary become completely necessary. If you’re worried that your qualified intermediary is not trustworthy, read our guide. We’ll explain the questions you should ask your qualified intermediary.

When you’ve found the potential replacement properties, you must submit a description of their location and condition to your qualified intermediary. There are a few descriptions that are acceptable, they are listed in order of preference:

- Legal Description – Usually from a surveyor

- Lot and Block description

- Street Address

- Number assigned by a local city or county

In addition to describing the physical property location, you must also identify the attached personal property. This could be something like a washer/dryer, oven, or closet cabinets.

After you’ve identified the properties and submitted them to your QI, you will sign documents to make it official. You can change properties up until the 45th day, but after that your selections are locked in. Hopefully this helps with your time frame for 1031 exchange.

The 180-Day Exchange Period – The Purchase

This period is much easier to understand. You’ve sold your old property and identified new potential replacements. After the 45th day there’s only one thing left to do: close on the property and take ownership within 180 days. The time frame for 1031 exchange is extremely stringent! As a reminder, the “clock” does not restart when you identify replacement properties, it continues running.

While it’s simple, there is one “gotcha” to watch out for. If you must file taxes during the 180-day period, your exchange is due on that date. For example, if you start an exchange on February 14th (I’m sure your significant other would not be pleased), and have income taxes due April 15th, you must complete the exchange by April 15th.

The only way around this rule is to request an extension to file your taxes. Using the same example above, if you get an extension on your taxes the exchange is still due within 180-days, since that will come first. If you’re not sure you’ll find a replacement property quickly, it may make sense to start your exchange after April 15th or before Oct 19th. Also, the 1031 exchange DST structure can make it much easier to identify and close on a replacement property.

Other than filing for extension on your taxes, there is only one other way to get the 180-day period extended. If your property is victim to a natural disaster and emergency zone, you may have claim for an extension. Other than that, hardly any extensions are approved for any reason, even significant hardships. Make sure you can complete the time frame for 1031 exchange within 180 days!

Time Frame For 1031 Exchange Calculator

If you sold a property recently, use this handy time frame for 1031 exchange calculator below. By starting with the date your property originally sold, it will give you the 45 and 180 day deadlines. These are the most important dates to remember in your time frame for 1031 exchange!

Reverse and Construction Time Frame for 1031 Exchange

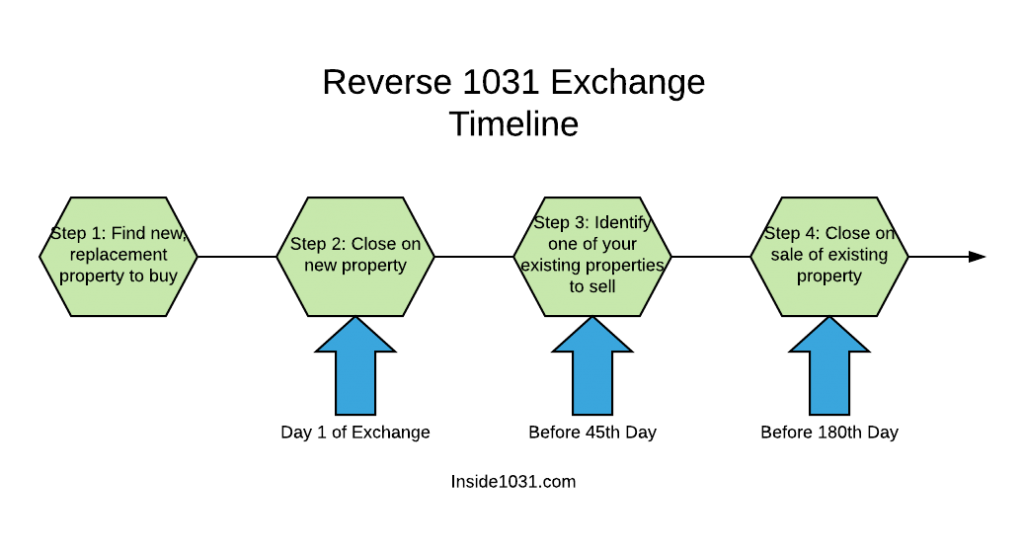

A point of confusion among investors are the timelines for reverse and construction exchanges. Both of these are complex exchanges that should be completed with the help of a qualified intermediary.

Time Frame for Reverse 1031 Exchange

Believe it or not, the time frame for a reverse 1031 exchange are the same as delayed, but backwards. In a reverse exchange, you buy the new property first, then sell your old property. You must identify the property you are going to sell after 45 days, then close on the sale within 180 days. This can be much easier to plan and ensure you’re buying a good deal. Investors like the reverse exchange because they can devote their time upfront to finding a good deal. Then, they will sell their existing property slightly below market, which other investors will scoop up quickly!

Time Frame for Construction 1031 Exchange

Construction or Improvement exchanges are structured as either a delayed or reverse exchange. In a traditional, delayed construction exchange the timelines are the same as before. You must sell your old property, identify a new one within 45 days, and close within 180 days. The only difference is that in a construction exchange you must use an EAT to hold title while improvements are made. We’ve written extensively about the improvement exchange here.

For a reverse construction exchange, the rules are similar. You must purchase the new property and make improvements while you look to sell your old property. Reverse construction exchanges are one of the most complex exchanges you can do, and requires a qualified intermediary and complex LLC’s. Hopefully this article has cleared up the time frame for 1031 exchange of all types!